Blog

Trusted Northwest Suburban Law Firm

847-944-9400

One More Reason to Form a Series LLC

By Marta Truskolaska

Since the state of Illinois became one of a select few in the United States to allow the establishment of subsidiary (series) LLCs under a Master LLC, the Series LLC in Illinois has become an advantageous and desirable entity for many Gardi, Haught, Fischer & Bhosale LTD clients.

There are many reasons to form a Series LLC in Illinois, which allows businesses to establish a series of LLCs under a Master LLC. The arrangement is often the best choice in instances where:

• The business is diverse and made up of multiple entities. For example, one business owner may have two completely unrelated operations, like a bike shop and an ice cream shop.

• The business owns and operates real estate and wants to limit liability. The Series LLC allows a property owner to limit risk of liability by forming a Series where each property is titled to an individual series. With all business operated separately, liabilities are insulated from one another if any one series is sued by a creditor.

• The business owner wants to reduce administrative costs. This continues to be the most attractive reasons to form a Series LLC.

According to a press release concerning reduction of LLC filing fees in Illinois from the Secretary of State, the office processes and files approximately 20,000 LLC annual reports and documents every year. The Series formation has always provided a significant administrative savings for business owners over registering each LLC separately. Now, however, filing a Series LLC is even more affordable since IL Senate Bill 867 passed last year, reducing filing fees for LLCs in Illinois.

The fee for registering a Series LLC in Illinois has now dropped from $750 to $400. The filing fee for each series has been reduced from $150 to $50.

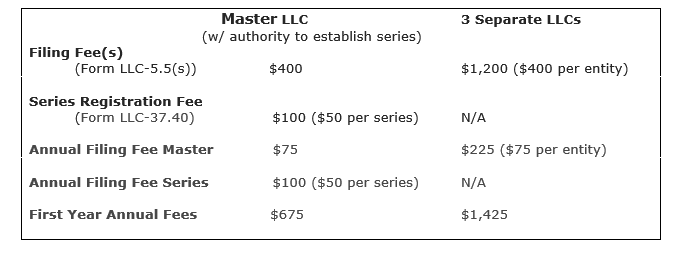

As shown in the chart below, even with the reduction in administrative fees across the board for all LLCs, establishing Series still takes the lead as the most affordable way to administer more than one LLC.

Compare the administrative fees for a business owner who establishes a Master LLC and two Series as opposed to three separate LLCs in Illinois. As shown in the chart, the Series saves more than 75 percent over filing individual LLCs for each entity.

At Gardi, Haught, Fischer & Bhosale LTD we are experts at helping businesses establish Master Series LLCs for all the benefits they bring to a business. If you are interested in exploring the opportunity or amending your operating agreement to include of all your requirements, please contact us for a consultation or fill out the free case evaluation form below.